LightStream offers flexible and affordable loans

LightStream is leading the way in approving loans for all audiences and promises to overtake big banks like Bank of America, Sofi Loans, HSBC, and Citi.

LightStream is the online consumer lending division of Truist, which formed in 2019 from the merger of BB&T and SunTrust. SunTrust acquired the assets of online lender FirstAgain in 2012 and relaunched the business as LightStream. LightStream’s online personal loans range from $5,000 to $100,000 and can be used for nearly any reason. Personal loans are available to borrowers nationwide.

The lender boasts no origination, late payment or prepayment fees, and offers rate discounts for borrowers who sign up for autopay. Loans are available between $5,000 and $100,000 for terms ranging from two to 12 years depending on your loan purpose. Plus, with a minimum credit score of 660, LightStream is a strong option.

Best for debt consolidation

Because it doesn’t have any fees — including late fees — and has a low APR, LightStream is a great option for debt consolidation if you have good to excellent credit. And since LightStream also has loans up to $100,000, you will be able to combine a large amount of debt into one monthly payment.

Its quick application process means you won’t have to wait long to know if you have been approved.

Low prices and no fees:

LightStream offers low interest rates that vary from lender to lender, depending on the loan amount, purpose, repayment term, and applicant’s creditworthiness. Good credit is required to get the lowest interest rates, and a borrower who chooses Autopay can receive her 0.5% rebate.

LightStream does not charge any fees for lending, late payment, or prepayment.

Booking availability:

LightStream’s wide range of available repayment terms (2 to 7 years for most loans) allows borrowers to prefer lower total interest rates on shorter terms or lower monthly payments on longer terms. You get the opportunity to prioritize.

Special do-it-yourself features:

Borrowers with good or good credit who want to finance a home improvement project can qualify for extended loans of up to 12 years without screening or homeownership requirements. Longer payback periods can make monthly payments more affordable for expensive home projects such as: Lenders can also delay funding a loan for up to 90 days. This gives the borrower more time to adjust the conversion without additional interest.

Rate beat program:

According to LightStream, if he can show that he has been approved by a competitor for an unsecured fixed-rate loan on the same terms, he has a 0.10 percentage point advantage over the competitor’s rate.

Experience Guarantee:

LightStream will refund $100 to the borrower who is not satisfied with receiving the loan within 30 days. To receive $100, you must contact the company and fill out a survey.

Pros

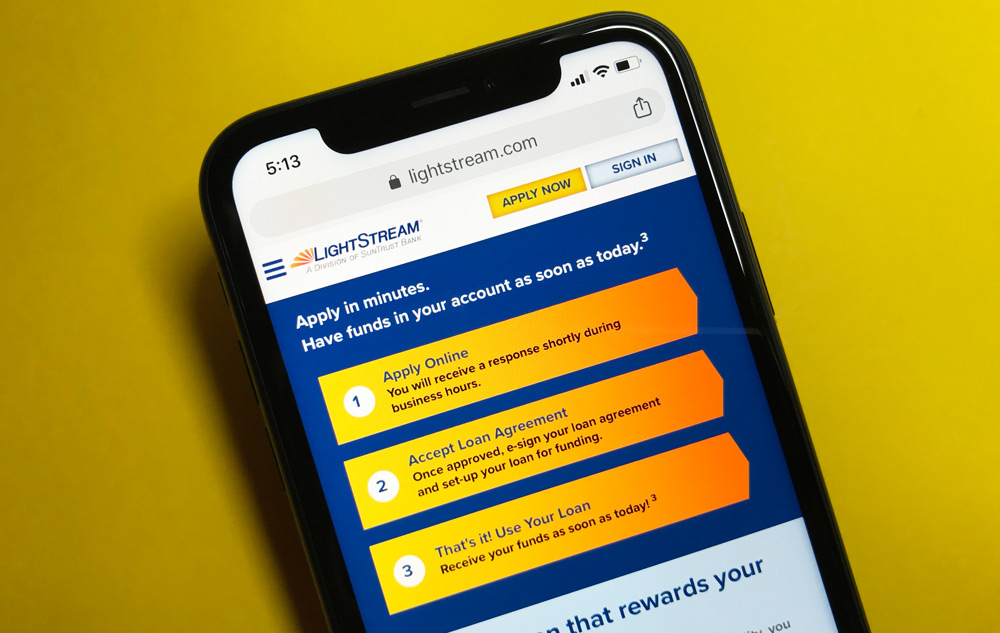

Good user experience. LightStream operates entirely online, and its website is simple and easy to navigate. The application is quick and can be completed using a phone, tablet or computer.

Fast funding timeline. You can receive funding as soon as the day that you apply for a loan with LightStream, and the funds are deposited directly into your bank account.

Loan terms up to 84 months. You can apply for repayment terms from 24 months to 84 months, which gives you more flexibility in finding an affordable monthly payment.

Find loans for more than 30 different purposes, from buying a car to financing a horse.

Borrow from $5,000 to $100,000.

Pay no origination, prepayment or late fees.

LightStream requires you to use your personal loan for the purpose you selected in your application. Loans can be used to finance:

Vehicles. Purchase a new, used or classic car; get a motorcycle; buy out a lease; or refinance.

Home improvement loans. Finance a basement remodel, a hot tub, a kitchen makeover, a landscaping project, a solar energy system or a pool.

Recreation loans. Pay for a big-ticket item, such as a boat, an aircraft, an RV, a timeshare or destination club, or refinance a boat loan, an RV loan or boat repair.

Loans for family needs. Cover adoption costs, medical or dental procedures, in vitro fertilization and fertility treatments, pre-K through 12th grade educational expenses, or weddings.

Other purchases. Consolidate debt, pay for an engagement ring, buy land or finance a tiny home.

To apply for your loan, click below.