Orange and Paysense Loans: Empowering Financial Solutions for Individuals

In today’s fast-paced world, efficient communication between banks and their customers is crucial.

Anúncios

The advent of digital platforms has revolutionized the banking industry, offering convenient solutions for financial transactions and services. Paysense, a leading lending platform, has emerged as a prominent player in providing loans to individuals.

This article explores the significance of Paysense loans and the role of Orange Telecommunications System in facilitating effective communication between banks and their customers.

Paysense Loans: A Pathway to Financial Empowerment

Paysense has been at the forefront of empowering individuals by offering accessible loans. The platform has revolutionized the traditional lending process by leveraging technology to provide quick and hassle-free financial solutions. Whether it’s for education, healthcare, or personal expenses, Paysense offers a range of loan options tailored to individual needs.

One of the standout features of Paysense loans is the streamlined application process. By embracing digital advancements, Paysense has simplified the loan application journey. Customers can easily apply for a loan online, eliminating the need for extensive paperwork and long waiting periods. The platform’s user-friendly interface ensures a seamless experience, allowing customers to complete their applications conveniently.

Facilitating Communication: Orange Telecommunications System

Effective communication between banks and customers is the backbone of a successful financial ecosystem. Recognizing this, Paysense has collaborated with Orange Telecommunications System to enhance their communication channels. Orange, a renowned telecommunications company, offers robust infrastructure and services that empower banks to establish reliable connections with their customers.

Orange Telecommunications System’s wide network coverage ensures that customers in various regions have access to consistent communication services. Through their extensive network of towers and fiber-optic cables, Orange enables uninterrupted communication channels, minimizing disruptions and ensuring a seamless banking experience for customers.

The collaboration between Paysense and Orange has also facilitated the implementation of innovative communication solutions. The integration of Orange’s technologies allows Paysense to reach a larger customer base, enabling better outreach and engagement.

With Orange’s secure and reliable network, customers can interact with Paysense through various channels, including phone calls, SMS, and internet connectivity, ensuring convenience and accessibility.

The combination of Paysense loans and the facilitation of communication through the Orange Telecommunications System has revolutionized the way banks engage with their customers.

Paysense’s commitment to providing accessible loans, combined with Orange’s robust infrastructure, has created a seamless banking experience for customers.

By streamlining the loan application process and enhancing communication channels, the Paysense-Orange partnership contributes to financial empowerment and inclusion. With technology as an enabler, the future of banking holds immense potential for further innovations, enhancing the way individuals access and utilize financial services.

Paysense Loans: Empowering Financial Solutions for Individuals

In today’s fast-paced world, financial flexibility and accessibility are paramount. Whether it’s for unforeseen expenses, educational pursuits, or personal aspirations, having access to quick and convenient loans can make a significant difference in an individual’s financial journey.

Paysense, a leading lending platform, has emerged as a reliable and innovative solution for individuals seeking financial support. This article delves into the world of Paysense loans, exploring their features, benefits, and how they empower individuals in achieving their goals.

Paysense Loans: A Pathway to Financial Freedom

Paysense loans have revolutionized the traditional lending process, prioritizing convenience, speed, and transparency. The platform’s user-friendly interface and seamless digital experience make it an attractive choice for borrowers. With Paysense, individuals can apply for loans entirely online, eliminating the need for tiresome paperwork and long waiting periods typically associated with traditional lending institutions.

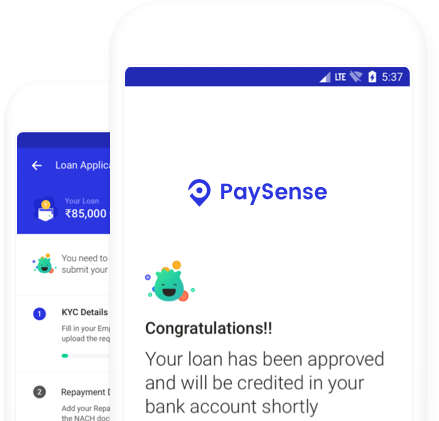

The application process for Paysense loans is straightforward and hassle-free. Borrowers can easily navigate the platform, providing necessary information and documentation to complete their application. Unlike traditional banks, Paysense leverages technology and advanced algorithms to assess loan eligibility swiftly and provide borrowers with instant approvals or rejections.

This rapid turnaround time sets Paysense apart from conventional lending channels, allowing borrowers to make timely decisions regarding their financial needs.

Flexible Loan Options and Competitive Rates

Paysense understands that individuals have diverse financial requirements. To cater to a broad range of needs, the platform offers flexible loan options with varying repayment terms. Whether it’s a small amount for an immediate expense or a larger sum for a long-term investment, Paysense has loan options to accommodate different financial situations.

Moreover, Paysense loans come with competitive interest rates, ensuring affordability for borrowers. The platform employs a fair and transparent pricing model, enabling individuals to understand the costs associated with their loans upfront. By providing clear information on interest rates, processing fees, and repayment terms, Paysense promotes responsible borrowing and empowers individuals to make informed financial decisions.

Convenience and Accessibility

One of the key advantages of Paysense loans is their accessibility. The platform prioritizes inclusivity, making loans available to individuals from diverse backgrounds, including those with limited credit history. This accessibility is particularly crucial for individuals who may have faced challenges in obtaining loans through traditional banking channels.

Paysense’s digital approach enables borrowers to access loans anytime, anywhere, as long as they have an internet connection. This convenience eliminates the need for physical visits to banks and allows borrowers to complete the loan application process from the comfort of their homes. Furthermore, Paysense offers dedicated customer support, ensuring that borrowers receive prompt assistance and guidance throughout their loan journey.

Paysense loans have revolutionized the lending landscape by combining cutting-edge technology, convenience, and accessibility. Through its user-friendly platform, rapid approvals, flexible loan options, and competitive rates, Paysense empowers individuals to fulfill their financial aspirations and navigate unforeseen expenses confidently.

The platform’s commitment to transparency and inclusivity has made it a preferred choice for borrowers seeking quick and reliable financial solutions.

As Paysense continues to innovate and expand its offerings, it is reshaping the way individuals approach loans, offering a pathway to financial freedom and flexibility. In a world where financial empowerment plays a pivotal role in personal growth, Paysense’s commitment to providing accessible loans is paving the way for a brighter and more financially inclusive future.